Navigating Life Insurance as a Type 1 Diabetic: My Personal Journey and Key Lessons Learned

Disclaimer: The content you’re about to read may contain affiliate links to products I love and recommend. Which means, I may earn a small commission from items purchased through these links (at no additional cost to you) which helps me provide even more awesome content for you 😊 I appreciate your support!

It’s the Saturday after Mother’s Day and I’m enjoying my morning coffee, still basking in the glow of last weekend. My husband and kids went above and beyond to make me feel loved and celebrated. I slept in, enjoyed a delicious brunch complete with mimosas, and was showered with flowers and thoughtful gifts—including the car laptop converter I had my eye on. But the cherry on top? A much-needed and long-overdue pedicure gift card tucked inside a homemade card. It was perfect.

As I sat back and smiled at the memories, my mind jumped ahead to Father’s Day. It’s only a month away, and if there’s anything I’ve learned from being a mom, it’s that planning ahead is key. If you’re like me, you want your guy to feel just as seen, appreciated, and celebrated—but you also want gift shopping to be as easy as clicking a button while the kids nap.

That’s why I put together this handy and heartfelt guide to the Top 10+ Father’s Day Gifts- plus some bonus ideas that your man is sure to love. Even better? You can simplify your life by just clicking the links and ordering from the comfort of your couch.

No last-minute stress, just great gifts for a great guy.

Whether you’re shopping for the outdoorsy dad, the sentimental softie, or the tech-savvy multitasker, I’ve got you covered with thoughtful ideas, meaningful surprises, and convenient links that make gifting a breeze.

1. Give Him the Gift of Relaxation: Massage Gift Card

Every hardworking dad deserves a little R&R. Let’s face it—most dads won’t book a massage for themselves.

A massage gift card is a luxurious treat he likely wouldn’t buy for himself— but will definitely appreciate when you gift it!

Budget-friendly option: break out your favorite massage oil and treat him to a relaxing rubdown during the kids’ nap time – or better yert, after the kidse are in bed!

2. Give Him the Gift of Golf: Gift Card to His Fav Local Course

For the golf lover, nothing says “I love you” like four uninterrupted hours on the green.

Whether he’s a weekend warrior or just loves to unwind on the green, a golf gift card is a hole-in-one.

- Pair it with a funny golf towel or custom “Best Dad by Par” tee from Etsy for a personal touch.

Top Secret Tip: find a local course and grab him a gift card—then schedule some you-time while he plays!

3. Groomed & Handsome: Personal Care Hygiene Set

Help him upgrade his self care & skincare game (without raiding your drawer). The Arbonne GroomWell Set is a luxury self-care kit that will last up to six months, and is packed with clean, plant-based ingredients, everything he needs to look and feel his best!

Includes:

-

Invigorating Cleanser

-

DermResults Advanced Eye Cream

-

Weightless Moisturizer,Cream with SPF 15

-

Charcoal 3-in-1 Face-Hair-Body Wash

Bonus: the eye cream actually works! He’ll look refreshed—even if the toddler kept him up all night.

A true upgrade to his self-care routine!

👉 Click here to grab the GroomWell Set

Don’t forget to use coupon CODE: Arbonne10 for 10% discount!

4. Fragrance Favorites For the Good Smelling Guy

There’s something about a good-smelling man that makes your knees weak, am I right? Two tried-and-true faves in our house are:

-

Jimmy Choo Man Intense – bold and masculine

-

Dime No. 1 Cologne – clean, subtle, affordable luxury

A spritz a day keeps the dad-bod blues away.

Give the gift of a good-smelling man. He’ll smell amazing, and you’ll reap the benefits. 😉

For the health-conscious dad, this is the cleanest, purest nutrition set on the market.

It includes:

-

Vegan Protein Powder

-

Energy Fizz Sticks

-

Gut-health support (pre/probiotics + enzymes)

-

CleanTox Herbal Detox Tea

Clean. Delicious. Convenient. Perfect for the guy who values fitness and feeling good.

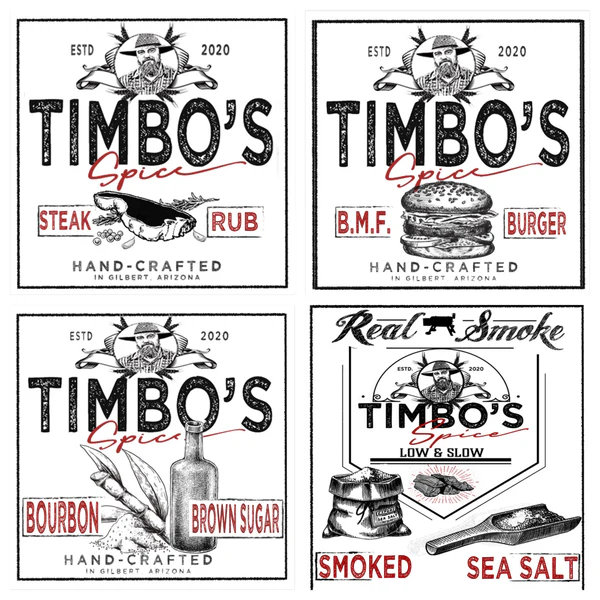

6. Spice It Up: Timbo’s Handcrafted Spice Bundles

For the guy who grills everything from burgers to Brussels sprouts, Timbo’s Spices are next-level. Perfect for the grilling enthusiast! These Arizona-born blends are clean, flavorful, and addictive.

🔥 Bundle Options:

Bonus: They make everything taste gourmet with zero effort!

7. Personalized Sentimental Gifts (Etsy Favorites!)

Sentimental gifts always hit the hardest. Some of our most cherished Father’s Day gifts are the ones made just for him:

- Kid’s Face Socks (yes, socks with our daughter’s face—he still wears them!)

- Personalized illustrations of dad and kids

- “Best Dad by Par” Tee

- Leather Bracelet with the kids’ names

- Custom coffee mugs, golf balls, or magnets – these gifts take a bit more planning, so don’t wait too long to place your orders!

Every time he wears or sees one of these gifts, he lights up. ❤️

8. Handy Car Gadgets: Tire Inflator & Laptop Power Inverter

Practical and essential!

Two of our most-used gadgets are also two of the most practical gifts I’ve ever given my husband:

-

Portable Tire Inflator – this compact and powerful lifesaver is easy to use and comes in handy more than you’d think. Trust me, every car owner should have one!

-

Power Inverter Car Adapter – If your man works from the car (like I do), this device is a must. Keeps laptops and devices charged (phones, kids’ tablets, breast pump, etc.) on the go so work never gets interrupted—perfect for dad who’s always on the road or low on battery!

9. Beats Earbuds – Music, Podcasts, Phone Calls

If he doesn’t already have a pair of Beats earbuds, get ready to be the favorite gift-giver. The sound quality is unmatched, and they’re perfect for listening to music during workouts, taking work calls, or podcast binges. Whether he’s mowing the lawn or hitting the gym, Beats are a top-tier gift!

Sleek. Comfortable. Totally worth it.

10. Olukai Flip-Flops for the Laid Back Dad

High-quality, ultra-comfy flip-flops for the relaxed dad. Discovered by accident on a beach vacation, now it’s the only brand my husband will wear. They’re stylish, durable, and oh-so-comfy.

* Bonus Father’s Day Gift Ideas *

- Blackstone Griddle – This game-changer took over our family a few years ago. Starting with my brother-in-law, then my dad, and finally my husband. The flavor it adds to meals is unmatched—and it might even encourage him to cook more often. Win-win!

*SUPER EASY DIY : LOW COST & PERFECT FOR LAST MINUTE:

- DIY “We’re Nuts About You, Dad!” Printable – Create a sweet keepsake with this FREE “We’re Nuts About You, Dad!” downloadable frame with customizable photo. Easy, adorable, and totally from the heart. Great for younger kids to gift their dad something handmade. Editable in Canva with your personalized photo! You can even order it as a tumbler, mug, or magnet, all conveniently through Canva too! Or, just simply print from the comfort of your own home and frame!

👉Click here to customize FREE download

- DIY Printable Poem with Hand print Art – print out this sweet poem, grab some paint and add your child’s handprint. Sentimental, sweet, and practically free!

👉Click here to download FREE Poem & handprint template

- DIY Heart Shaped Collage FREE Printable – grab a bunch of photos of your pops + you, or your kiddos & hubby and simply upload to Canva and print from the comfort of your own home! Easy, adorable, and totally from the heart. * Pro Tip: Go the extra mile and frame it!

👉Click here to customize & print FREE Heart Shaped Photo Collage

The perfect Father’s Day gift doesn’t have to be expensive or over-the-top. Father’s Day is about honoring the incredible men who guide, protect, teach, and love our families with everything they’ve got. Showing him appreciation for all he does, making him feel seen, and giving him a moment of rest or joy. Whether you go for a meaningful personalized gift or a game-changing gadget, the point is to make him feel celebrated—and to make your life easier while doing it.

So go ahead—simplify your life by clicking to order any of these amazing finds. Surprise him with something thoughtful and practical. You’ll be glad you did, and he’ll feel the love.

💬 Drop a comment below and share your spectacular go-to Father’s Day gifts—or a fun story about the best gift you’ve ever given or received!

Let’s help each other make this Father’s Day one to remember. 💙

Need help finding a specific link or creating your own DIY printable? Drop a comment or send a message—I’ve got you!

Happy shopping, happy gifting, and happy Father’s Day, Friends!

XO,

Allison

Wishing my husband and “Dat”/ Papt T a very Happy Father’s Day!

0 Comments